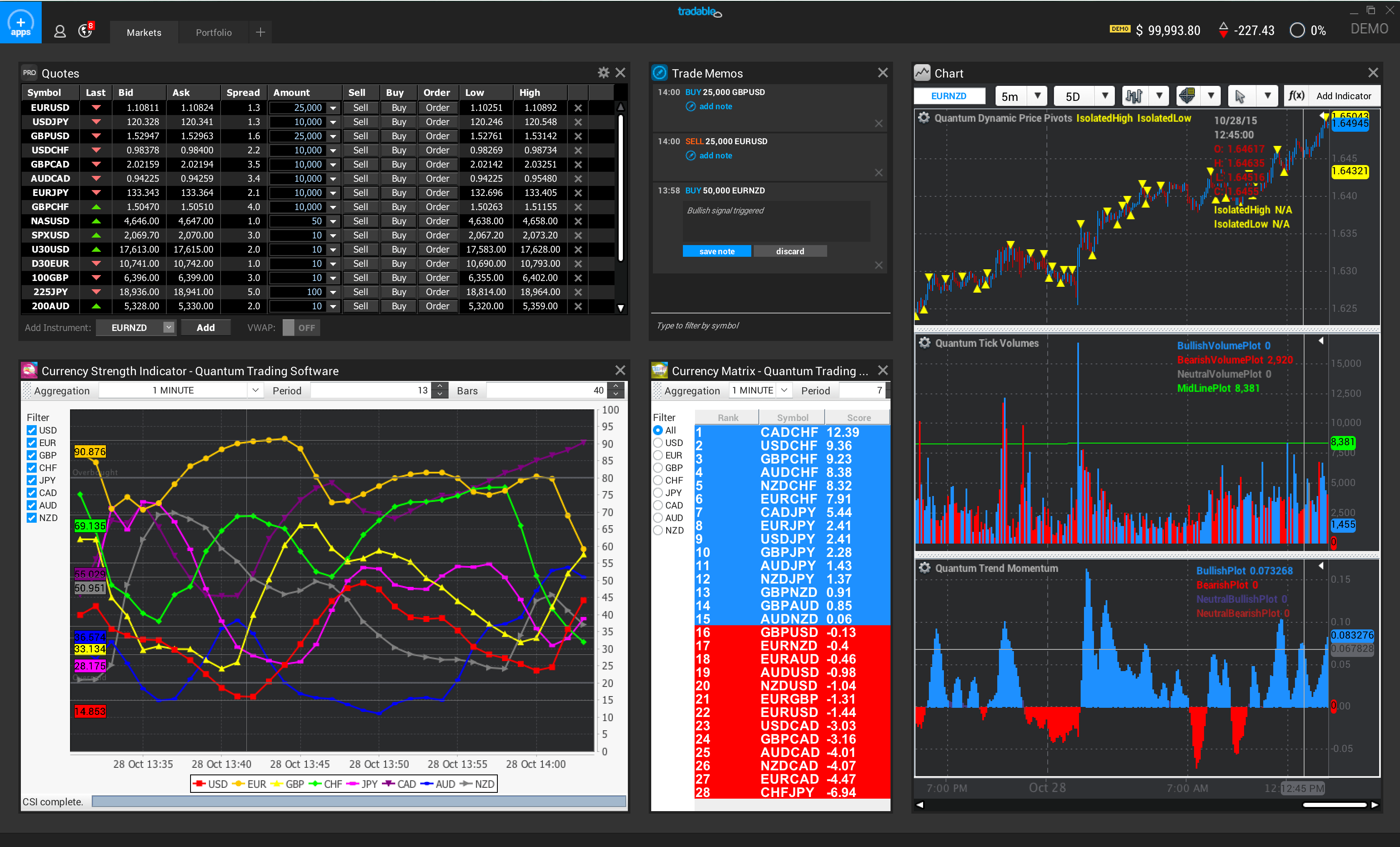

The following article helps investors, especially the novice ones, to understand and essence of CFD trading. The latter is now widely popular among inline traders and provides high opportunities to make money. By fully estimating the advantages and meanwhile being aware of risks investors can easily overcome trading difficulties.

If you want more profits at the forex platform, then you need to check it out along with the significance. There are massive opportunities available to the users. The learning of benefits is essential for the traders. It helps you to trade in the best way to have desired results. Along with it, stay aware of the risks.

Why should readers be interested in the post?

The article will be useful for readers as due to it they will be able to gain a knowledge of CFD trading, learn about its peculiarities and in case of trading, escape failure. So if you are interested in online trading you should know that CFD trading is of utmost significance for investors now to increase the chances of profit.

CFD Trading and Its Significance

The concept of CFD trading lies on the contract between the buyer and the seller where the difference between the opening and closing prices is paid the buyer by the seller. The buyer pays the seller if the difference turns out to be negative.

CFDs were firstly traded in early 1990 on the stocks of London Stock Exchange. At that period they were accessible only to institutional traders who used them to hedge their exposure on the underlying asset. CFDs became widely accepted by retail traders at the end of 1990s and up till now is popular among traders.

Price movement up or down is an advantage for traders to make profit. The price movement up is a sign for them to open long positions and conversely the downside movement indicates opening short position.

Long trade is chosen once the trader buys an asset and expects its further rising. And logically they open short position when selling an asset and expecting the further decrease of its price. In the traditional stock market it’s almost impossible to open short position; however CFD trading allows traders to go short as easily as they go long. It also helps to make profit even if the price falls but you trade properly.

The trade is realized by the participation of individual traders and CFD providers. Each trader should specify his own contract terms since there does not exist a standard one. It is opened while starting the trade on the specific tool and only when closing the position the profit or loss becomes obvious. Once the positions are not expired and remain open overnight they will be rolled over.

The trader should keep the minimum margin level to keep the position open as CFDs are traded on margin. If the amount deposited falls below the minimum margin the trader will get a margin a call warning about the necessity of paying additional money. The positions will be subject to liquidations if the margins are not covered immediately.

Peculiarities of CFD trading

Advantages

- Trading on margin which is a great way to enlarge trading

- Making profit from market movement up and down

- Cost reduction because of the lack of taxes and hidden commissions

- Availability of about 80 stock CFDs, Equity Indices and commodity CFDs

- Availability of unique Golden Instruments

- Beneficial Swap conditions

Risks

- Trading on margin can work both in the benefit of traders and in their disfavor, meaning that it may serve as a great source if income and meanwhile be very risky and cause significant losses. The main means of escaping losses is to place stop loss order when noticing the position moves against you.

- Long term investors may undergo more risk since holding a CFD open for a noticeably long time may increase the costs and so it would be more useful to have bought the underlying asset.

The main logic of CFD trading is similar to the traditional currency trading. Here, however, you can trade Index, Commodity, and Equity CFDs including hundreds of trading instruments.